Business Challenges

A reputable bank faced challenges in scaling its Robotic Process Automation (RPA) program across the enterprise due to fragmented processes, governance issues, and the absence of a clear automation roadmap. Inconsistent bot performance and challenges in maintaining and optimizing bots’ post-deployment further complicated the process. Additionally, the bank struggled to identify new automation candidates and measure ROI, which slowed progress and faced resistance from various business units. To address these challenges, the bank sought to enhance its automation strategy for improved efficiency, seamless governance, and maximize ROI across the enterprise.

What We Did

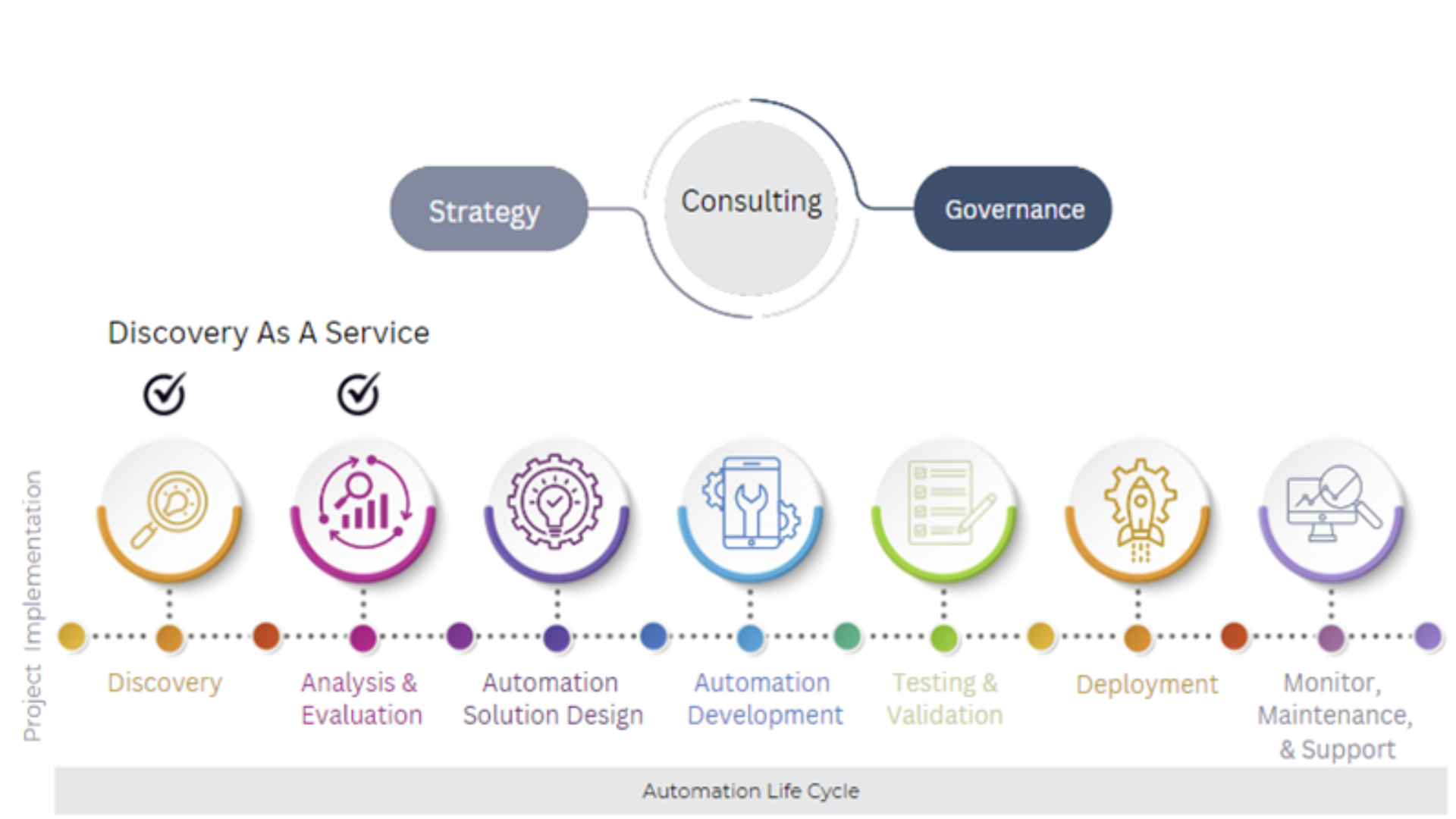

We implemented a structured RPA scaling framework, leveraging Primus’ RPA Discovery as a Service to address process identification, governance, training, support, and long-term performance monitoring. The solution enabled the bank to standardize its approach to automation, enhance governance and oversight, and deploy a clear roadmap for scaling RPA across the enterprise while maximizing ROI.

Business Benefits

- Accurate Process Identification: RPA Discovery as a Service leverages advanced analytics to map high-potential processes for automation, ensuring focus on impactful, scalable tasks.

- Maximizing ROI: The service prioritizes automation opportunities based on process complexity, volume, and value, ensuring highest ROI and greater efficiency.

- Accelerated Automation:The discovery service streamlines identification and analysis, reducing manual assessments and speeding up the entire automation lifecycle.

- Enhanced Governance and Compliance: The service offers cross-departmental process insights, ensuring RPA initiatives adhere to regulatory standards and reduce risks.

- Data-Driven Decision Making: RPA Discovery as a Service delivers detailed analytics and reporting to guide impactful RPA deployment, track ongoing performance & improvements.

Technologies Used

The following tools were utilized by Primus in support of our methodology for this project.

Key Components of the Solution:

Enhanced Governance and Standardization:

Problem: The bank lacked centralized governance, resulting in fragmented and inconsistent RPA efforts across departments. This led to silos that hindered bot maintenance and optimal efficiency.

Solution Primus partnered with the bank to create an RPA Center of Excellence (CoE) for centralized governance and standardization of all RPA initiatives. The CoE took ownership of:

- Automation Roadmap Developing a clear, prioritized roadmap for scaling RPA aligned with business objectives and value drivers.

- Standards and Best Practices: Implementing standardized protocols for bot development, testing, deployment, and maintenance across departments to ensure consistency.

- Compliance and Risk Management: Ensuring all RPA efforts comply with regulatory and security standards, and managing risks associated with scaling automation.

Process Discovery and Prioritization:

Problem: The bank struggled to identify and prioritize additional processes for effective automation having the highest impact.

Solution The bank used RPA Discovery Service to assess processes, identify automation candidates, and prioritize them by complexity, value, and implementation ease.

- Automation Potential Assessment:Evaluated each process for automation potential based on frequency, error rates, manual intervention, and exception handling.

- Prioritization Framework: Prioritized processes based on ROI, business impact, & business priorities.

Training and Change Management:

Problem: Lack of internal expertise and employee resistance over job displacement hindered the bank's ability to scale RPA effectively.

Solution : A comprehensive training and change management program were launched to build internal capabilities and drive employee buy-in, including:

- RPA Training for Developers and Business Users: Upskilled IT and operations teams to build, deploy, and manage bots, enabling the bank to scale RPA independently.

- Collaboration with Departments: Ensured close collaboration between business units and IT to identify pain points and ensure RPA aligns with their objectives.

Scalability and Flexibility:

Problem: The bank's existing RPA infrastructure lacked scalability, causing deployment bottlenecks and integration challenges with legacy systems.

Solution The Bank adopted an enterprise-wide approach to scale the program across departments.

Comprehensive Analytics and ROI Measurement:

Problem: The bank struggled to measure the ROI and overall business impact of its RPA initiatives, making it difficult to justify further investments in automation.

Solution The Bank implemented a comprehensive analytics framework to track RPA performance and ROI.

- Automation Metrics:Tracked metrics like cycle time, error reduction, cost savings, and resource reallocation.

- ROI Dashboards: Provided a clear view of financial and operational benefits derived from automation, allowing leadership to make data-driven decisions about scaling RPA.

- Business Impact Analysis: Evaluated how RPA contributed to improved customer satisfaction, reduced operational risks, and better compliance.

About Primus

Primus is a trusted technology solutions leader, dedicated to serving its partners for nearly 30 years with exceptional solutions that enhance business efficiency, increase productivity, and boost profitability. Our comprehensive suite of services includes Enterprise Data Solutions, Intelligent Automation Solutions, Cloud Engineering Solutions, and Staffing Solutions, catering to various industry verticals such as Healthcare, Insurance, Telecommunications, Logistics, Food & Beverage, Media, Automotive, Real Estate, Manufacturing, Banking & Finance, and Energy.

About the Primus Intelligent Automation Practice

At Primus, our IA Practice leverages advanced technologies to empower organizations in their digital transformation efforts. By leveraging cutting-edge tools and solutions, we help businesses streamline operations, enhance process efficiency, drive innovation and deliver measured impact and ROI to the business. Our expertise in Intelligent Automation and hyperautomation ensures that companies can navigate the complexities of digital change, achieving significant improvements in performance and maintaining a competitive edge in today's fast-paced market.

Our core Intelligent Automation technologies include:

- Robotic Process Automation (RPA)

- Business Process Mapping (BPM) & Task Mining

- Chatbot

- GenAI, Artificial Intelligence, and Machine Learning

- Intelligent Document Processing (IDP) and Optical Character Recognition (OCR)